Dynamic Asset Allocation with Expected Shortfall#

Introduction#

The probability of not reaching a target asset amount or investment return on an investment is called shortfall risk. Introducing a measure of expected shortfall risk in portfolio optimization makes it possible to consider returns even in extreme models where the market moves dynamically. Xu et al. (2023) treated target returns as constraints in the Markowitz portfolio optimization model and proposed an iterative algorithm that dynamically adjusts target returns to meet target shortfalls. In this article, we use JijModeling and JijZept to implement this algorithm.

Dynamic Asset Allocation#

The dynamic asset allocation problem is the problem of allocating/investing funds in \(N\) assets to meet expected returns while keeping risk below a given threshold. A \(N \times D_\mathrm{total}\) matrix \(R\) representing the returns is obtained from the finance data. \(N\) is the number of stocks to be covered and \(D_\mathrm{total}\) is the number of days data are collected. We divide \(R\) into the period of \(T\) days and index the data for each period. For example, \(R_t\) represents the return data from \(t\)-th period. \(\mu_t\) is the mean value calculated from \(R_t\). Using these quantities, the covariance matrix of \(t\)-th period \(C_t\) is calculated as

where \(\mathbf{e}_i\) is a column vector of all zeros except with a one at the \(j\)-th position. Asset allocation could be a challenging problem during periods of unpredictable market turbulence. Therefore, we should set a threshold to avoid risk during those periods. The risk threshold can be set using observed market metrics from a volatile period, for example, the 2008 market crash. Major methods of risk measurement include:

Volatility: the standard deviation of the portfolio return.

Value-at-Risk at level \(\alpha\): the smallest number \(y\) such that the probability that a portfolio does not lose more than \(y\) of total budget is at least \(1−α\).

Expected Shortfall at level \(\alpha\): the expected return from the worst \(\alpha\)% cases.

In the following sections, we focus on the expected shortfall as our risk measurement and consider a formulation for the portfolio optimization problem.

Expected Shortfall-based Portfolio Optimization#

The expected shortfall al level \(\alpha\) is defined as:

where the weight vector \(w_t\) indicates what fraction of the budget is invested in each asset in the \(t\)th period. We minimize the expected shortfall, which is the worst-case average. Therefore, portfolio optimization considering expected shortfall becomes a problem of minimizing the expected shortfall \(\mathrm{ES}_\alpha\) under the constraints that the expected return is satisfied, the variance of the portfolio is small, and all assets are invested. However, the expected shortfall cannot be expressed by a quadratic formulation natively. If we reformulate it to QUBO, it is necessary to introduce new auxiliary variables. Therefore, to avoid this difficulty, we treat the expected shortfall as the convergence criterion. To do this approach, assuming that the assets’ historical returns follow a Gaussian distribution, we can approximate the expected shortfall of a given portfolio \(P\) by

where \(\mu\) is the expected return, \(\sigma\) is the volatility of the portfolio, and \(\phi(x)\) and \(\Phi(x)\) are the Gaussian probability distribution and cumulative distribution functions, respectively.

We use this criterion as the market risk.

For example, if the risk is small, we make a slightly larger investment to get a larger return.

Conversely, during periods of market turbulence and high risk, we take a lower risk of losing money in exchange for a smaller return.

To dynamically vary returns by the expected shortfall for a given period, Xu et al. (2023) proposed the following algorithm.

Algorithm: Expected Shortfall-based Dynamic Asset Allocation during period \(t\)

Input: \(\mu_t, R_t, \sigma_\mathrm{ref}, \sigma_{\mathrm{ref}, t}, \mathrm{ES}_\mathrm{ref}, \alpha\)

Output: \(w_t\)

1: \(p_t = \mathrm{mean} (\mu_t)\). // Initialize the target return

2: \(\mathrm{EST}_t = \frac{\sigma_\mathrm{ref}}{\sigma_{\mathrm{ref}, t}} \mathrm{ES}_\mathrm{ref}\). // Initialize the target expected shortfall

3: \(C_t = \mathrm{cov}(R_t)\) // Compute the co-variance matrix from the returns

4: while True do:

5: if \(p_t > \max (\mu_t)\):

6: return 0. // Return constraint cannot be satisfied

7: \(w_t\) = Markowitz(\(\mu_t, C_t, p_t\)). // Solve Markowitz formulation with annealing

8: \(\mathrm{ES}_t = \mathrm{ES}_\alpha (w_t, R_t)\). // Compute the expected shortfall using eq.(2)

9: if \(\frac{\mathrm{ES}_t}{\mathrm{EST}_t} > 1 + \epsilon\):

10: \(p_t = p_t (1-\delta)\). // Decrease target return for lower risks

11: else if: \(\frac{\mathrm{ES}_t}{\mathrm{EST}_t} < 1-\epsilon\)

12: \(p_t = p_t (1+\delta)\). // Increase target return as there is room for more risks

13: else:

14: return \(w_t\)

where \(\sigma_\mathrm{ref}\) is the volatility of a reference asset’s returns during the market crash in 2008. \(\sigma_{\mathrm{ref}, t}\) is the volatility of the reference asset’s returns during the \(t\)-th period. \(\mathrm{ES}_\mathrm{ref}\) is the reference asset’s expected shortfall during the market crash. \(\mathrm{EST}_t\) is the target expected shortfall at the \(t\)-th period. \(\alpha\) is the risk level parameter. \(\mathrm{ES}_t\) is the expected shortfall for the computed portfolio during the optimization process at \(t\)-th period. \(\epsilon\) is the error tolerance parameter, and \(\delta\) is the momentum parameter that is adjusted dynamically. The Markowitz optimization problem can be expressed by the quadratic optimization problem as:

For simplicity, we set \(w_{t, i}\) are binary variables in \(\{0, 1\}\). From the constraint \(\sum_i w_{t, i} = 1\), we concentrate our assets in one stock, and aim for the return to be always greater than \(p_t\).

Let’s code!#

Here, we implement a script that solves this problem using JijModeling and JijZeptSolver.

Defining variables#

We define the variables for Eq. (4).

import jijmodeling as jm

# define variables

N = jm.Placeholder('N')

p = jm.Placeholder('p')

mu = jm.Placeholder('mu', ndim=1)

C = jm.Placeholder('C', ndim=2)

w = jm.BinaryVar('w', shape=(N, ))

i = jm.Element('i', belong_to=N)

j = jm.Element('j', belong_to=N)

N is the total number of stocks, p is the lower limit of return \(p_t\), mu is the return \(\mu_t\) for each stock, and C is the covariance matrix \(C_t\).

w is the binary variable for optimization, and i and j are the indices, respectively.

Implementing Markowitz formulation#

Next, we implement Markowitz mathematical model Eq. (3).

# set a problem

problem = jm.Problem('shortfall')

# constraint 1: ensure the target return

problem += jm.Constraint('return', jm.sum(i, mu[i]*w[i])>=p)

# constraint 2: buy a stock

problem += jm.Constraint('onehot', jm.sum(i, w[i])==1)

# objective function: minimize variance

problem += jm.sum([i, j], C[i, j]*w[i]*w[j])

We generate a problem with Problem and then implement two constraints with Constraint.

We can implement the sum in two subscripts at once by using sum([i, j], ...).

With Jupyter Notebook, we can check the mathematical model implemented.

problem

Solve by JijZeptSolver#

We solve Markowitz portfolio optimization using jijzept_solver.

We implement subroutines to execute the algorithm proposed by Xu et al. (2023).

%%capture

# Install the required libraries

%pip install pandas-datareader yfinance

import jijzept_solver

import numpy as np

import pandas_datareader.data as web

from scipy.stats import norm

import yfinance as yf

# a function to compute reference vlatility and expected shortfall

def compute_reference(ref_asset, ref_start_date, ref_end_date, alpha):

ref_data = yf.download(ref_asset, ref_start_date, ref_end_date)['Close']

ref_volatility = ref_data.std()

ref_mean = ref_data.mean()

ref_expected_shortfall = ref_mean + ref_volatility * norm.pdf(norm.ppf(alpha)) / (1-alpha)

return ref_volatility[ref_asset], ref_expected_shortfall[ref_asset]

# a function to extract a solution from results

def extract_solution(solution, N):

df = solution.decision_variables_df

list_index = np.ravel(df[df["value"]==1]["subscripts"].to_list())

list_binary = np.zeros(N, dtype=int)

list_binary[list_index] = 1

return list_binary

# solve Markowitz optimization problem

def solve_markowitz(instance_data):

# compute using JijZeptSolver

interpreter = jm.Interpreter(instance_data)

instance = interpreter.eval_problem(problem)

solution = jijzept_solver.solve(instance, time_limit_sec=1.0)

w_t = extract_solution(solution, instance_data['N'])

return w_t

# compute expected shortfall from result of Markowitz optimization

def compute_shortfall(alpha, w, ret, vol):

es = np.dot(w, ret) + np.dot(w, vol) * norm.pdf(norm.ppf(alpha)) / (1-alpha)

return es

compute_reference is a function that computes the volatility \(\sigma_\mathrm{ref}\) and expected shortfall \(\mathrm{ES}_\mathrm{ref}\) of the reference data,

solve_markowitz is for solving the optimization problem Eq. (3).

extract_solution is a function that extracts the feasible and smallest objective solution from the result of solve_markowitz, and converts that solution to a binary vector.

Lastly, compute_shortfall computes the expected shortfall using the portfolio obtained from solve_markowitz.

Utilizing these subroutines, we implement the algorithm from Xu et al. (2023).

%%capture

from datetime import datetime

from datetime import timedelta

import pandas as pd

import pandas_datareader.data as web

# set input parameters, alpha, delta and eps

alpha = 0.99

delta = 0.1

eps = 0.25

# set start and end date for reference data

ref_start_date = datetime(year=2008, month=1, day=1)

ref_end_date = datetime(year=2009, month=1, day=1)

# compute volatility and expected shortfall from reference data

ref_volatility, ref_expected_shortfall = compute_reference('SPY', ref_start_date, ref_end_date, alpha)

# set the name of assets

list_assets = ['SPY', 'EEM', 'QQQ', 'SLV', 'SQQQ', 'XLF',

'AUDUSD=X', 'EURUSD=X', 'GBPUSD=X', 'CNYUSD=X', 'INRUSD=X', 'JPYUSD=X']

ref_asset_t = list_assets[0]

# set start date for data and date interval

start_date_t = datetime(year=2022, month=1, day=1)

dt = 14

# set the number of iteration

iteration = 6

# initialize lists for final results

list_results = []

list_shortfall = []

list_return = []

list_target = []

# main loop

for _ in range(iteration):

# set end date

end_date_t = start_date_t + timedelta(days=dt)

# get reference stock data

ref_data_for_volatility_t = yf.download(ref_asset_t, start_date_t, end_date_t)['Close']

# compute volatility

ref_volatility_t = ref_data_for_volatility_t.std()[ref_asset_t]

# compute target expected shortfall

target_expected_shortfall_t = ref_volatility / ref_volatility_t * ref_expected_shortfall

# initialize dataframe

data_assets = pd.DataFrame()

for asset in list_assets:

# get stock data and concat

data = yf.download(asset, start_date_t, end_date_t).rename(columns={'Close': asset})

data_assets = pd.concat([data_assets, data[asset]], axis=1)

# if nan exists, drop

data_assets_dropna = data_assets.dropna(how='any')

# compute mean

mean_t = data_assets_dropna.mean(axis=0).values

# compute covariant matrix

cov_t = data_assets_dropna.cov().values

# compute volatility

volatility_t = data_assets.std().values

# get the number of assets

N = len(list_assets)

# normalize mean, covariant matrix, and pt

mean_t_normalize = mean_t / mean_t.max()

cov_t_normalize = cov_t / cov_t.max()

p_t_normalize = mean_t_normalize.mean()

instance_data = {'N': N, 'p': p_t_normalize, 'mu': mean_t_normalize, 'C': cov_t_normalize}

while True:

w_t = solve_markowitz(instance_data)

if p_t_normalize > max(mean_t_normalize):

print('Caution!!! Return constraint cannot be satisfied!!!')

break

expected_shortfall_from_markowitz = compute_shortfall(alpha, w_t, mean_t, volatility_t)

if abs(expected_shortfall_from_markowitz) / abs(target_expected_shortfall_t) > 1.0 + eps:

instance_data['p'] *= 1.0 - delta

# elif abs(expected_shortfall_from_markowitz) / abs(target_expected_shortfall_t) < 1 - eps:

# instance_data['p'] *= 1 + delta

else:

break

start_date_t = end_date_t

list_results.append(w_t)

list_shortfall.append(expected_shortfall_from_markowitz)

list_target.append(target_expected_shortfall_t)

list_return.append(mean_t)

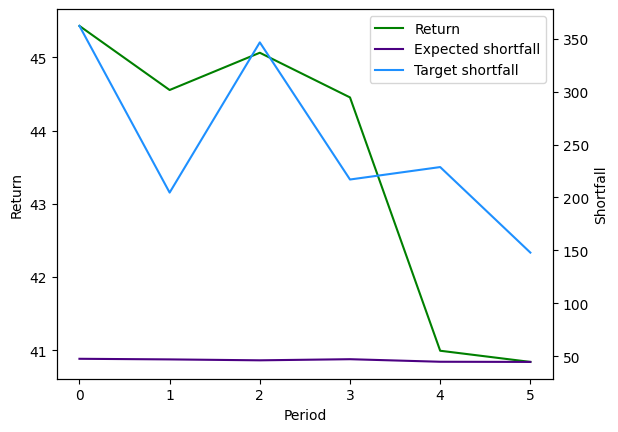

Visualize the result#

We plot the result obtained.

import matplotlib.pyplot as plt

list_final_ret = [np.dot(x, y) for x, y in zip(list_results, list_return)]

fig = plt.figure()

ax1 = fig.add_subplot(111)

ax1.set_xlabel('Period')

ax1.set_ylabel('Return')

ln1 = ax1.plot(list_final_ret, color='green', label='Return')

ax2 = ax1.twinx()

ax2.set_ylabel('Shortfall')

ln2 = ax2.plot(list_shortfall, color='indigo', label='Expected shortfall')

ln3 = ax2.plot(list_target, color='dodgerblue', label='Target shortfall')

h1, l1 = ax1.get_legend_handles_labels()

h2, l2 = ax2.get_legend_handles_labels()

ax1.legend(h1+h2, l1+l2, loc='upper right')

<matplotlib.legend.Legend at 0x7f0b1fddc880>

In the last period 5, the target shortfall is decreasing. The portfolio is chosen so that the expected shortfall decreases accordingly, resulting in a smaller return.